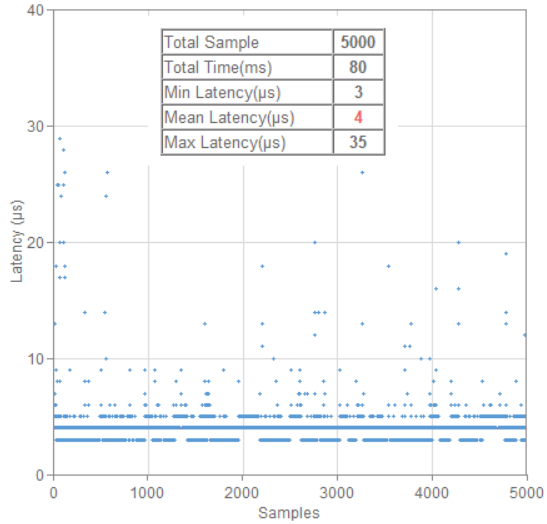

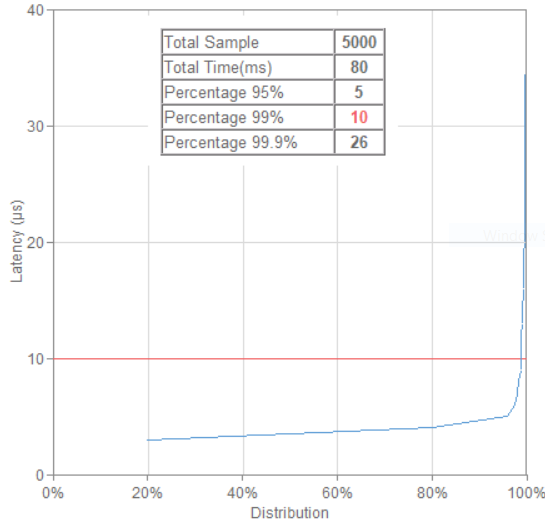

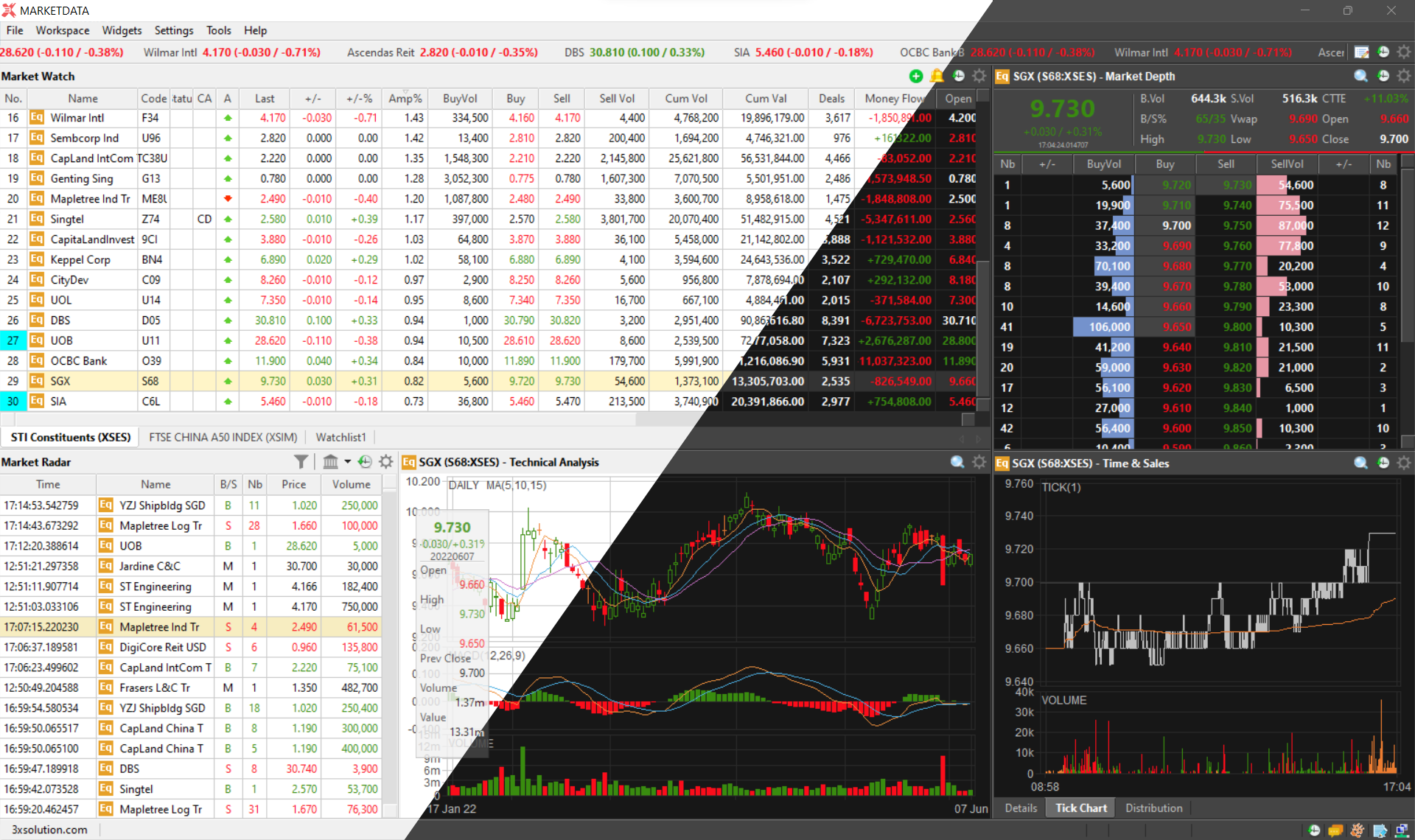

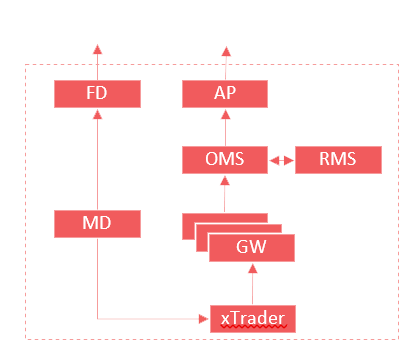

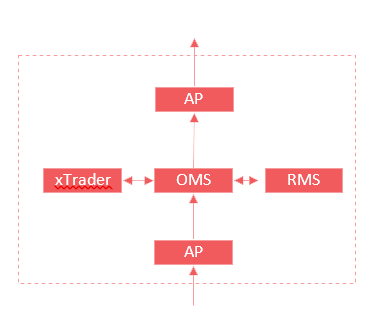

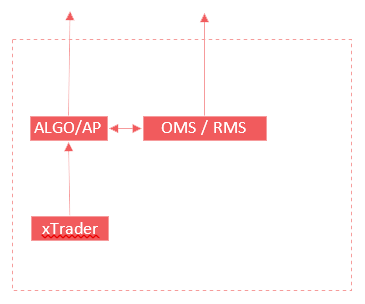

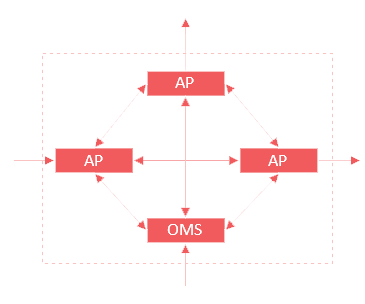

Ultra Low Latency • Algorithmic Trading Platform

3xSolution is an expert in developing ultra low latency trading platform for financial markets. We help our customers to grow, adapt and gain a technological advantage by providing custom software solutions and sharing our industry expertise. We are committed to providing an individual approach to each customer, focusing on delivering the best-in-class trading software.

Read More